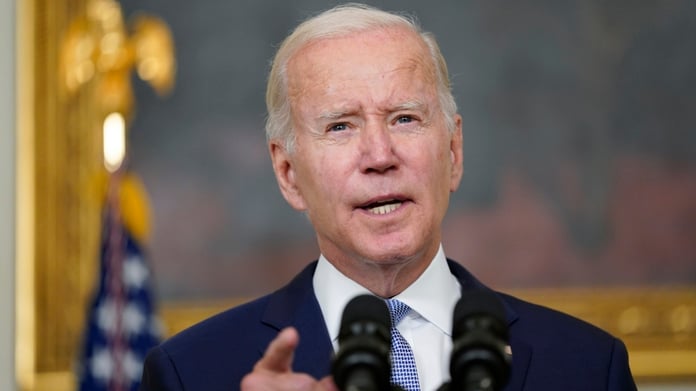

President Joe Biden on Friday urged Congress to give regulators more power over the banking industry, according to a statement released by the White House.

“No one is above the law,” Biden said in a statement, “and strengthening accountability is an important deterrent to preventing future mismanagement.” The current law “limits the administration’s power to hold executives accountable,” the president said.

Biden has asked Congress to give the Federal Deposit Insurance Corporation (FDIC) more power to return compensation, “including profits from stock sales – to executives of failed banks such as Silicon Valley Bank and Signature Bank “, the White House said in a statement. statement.

Silicon Valley Bank CEO Greg Becker sold $3.6 million worth of stock in late February, about two weeks before the bank was taken over by the FDIC, Bloomberg and CNBC reported.

“The President calls on Congress to expand the powers of the FDIC to prevent such incidents,” the statement said.

The president is also asking Congress to give the FDIC more power to exclude bank executives from the industry when their banks go into receivership and to penalize bank executives who fail their institutions.

Currently, the FDIC can only ban senior executives of failing banks from the industry if they are found to be complicit in “willfully and consistently ignoring” warnings of potential bankruptcy.

Additionally, the Dodd-Frank Financial Reform Act of 2010 directed regulators to develop new rules to ensure that cash bonuses paid to bankers do not encourage them to take unnecessary risks. However, the relevant rules have not yet been adopted.

Democrats calling for tougher banking regulations were quick to welcome Biden’s announcement, but it’s unclear whether the proposal will be bipartisan in Congress.

“We need to give them back every penny of their unfair pay and bonuses, impose real penalties, and make sure these executives never work in the banking industry again,” said Democratic Senator Elizabeth Warren.