Buffett made a name for himself and made his fortune through a “value investing” strategy that prioritizes long-term financial prospects over short-term profits, as well as a policy of holding shares of good profitable companies.

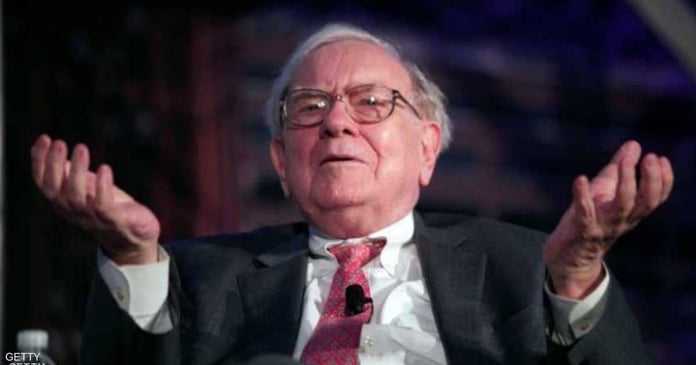

Despite owning an estimated fortune of $106 billion in 2023, according to Forbes, Buffett, who is 92, lives far from displays of extravagance and overspending, and his conversations and expectations have become inspirational. and a station. what is the world of finance and business waiting for, to find out what Hakim Al-Eqtisad’s view of the future of business is after more than half a century spent in successful investments.

The good times have passed

It appears Buffett, whose “Berkshire Hathaway” empire is seen as a beacon of the health of the US economy, is pessimistic about the future of business in the country. He announced it a few days ago at the Berkshire Hathaway group’s annual general meeting that the good times are over, and that the “extraordinary period” for excessive spending is over, indicating that his companies are overstocked, a sign that does not bode well, especially for those who believe that the United States will avoid a recession.

Who is Berkshire Hathaway Group?

Berkshire Hathaway owns a variety of companies, including Borsheims Fine Jewelry, Duracell, See’s Candies, Dairy Queen and Nebraska Furniture Mart. Investors always look to Buffett for economic insights as his business is closely tied to spending and public demand. Its ownership of BNSF Railroad, the largest freight network in North America, gives it extensive visibility and evidence of the level of freight being shipped across the country.

economic downturn

Global investing icon Warren Buffett expected earnings at many of his companies to decline in light of the economic downturn, despite ‘Berkshire Hathaway’s’ operating profits jumping over the in the first quarter of 2023, by 12.6%, to 8.065 billion dollars. , compared to 7.16 billion dollars for the same period of the previous year, supported by the recovery of the insurance activities of the group.

<

p class=””>compared to Buffett

Economist Ahmed Al-Khatib said in an interview with “Sky News Arabia Economy” that Warren Buffett compares the current period to the period of post-Covid-19 US markets, during which excessive spending was carried out by the consumers, due to the high liquidity that was present in the market, In the context of the pumping of financial assistance programs by the government, in addition to the measures taken by the United States Federal Reserve to stimulate the economy in the light of the pandemic, and this trend has contributed a lot to increasing corporate profits, as it has been accompanied by a return to normal life, after a long period of successive closures and a greater consumer propensity to spend.

The reason for pessimism

According to Al-Khatib, the reason for Warren Buffett’s pessimistic view is due to the changing market conditions, where the inflation rate increased dramatically, which reflected the pressure on prices and wages, and affected standard of living and people’s ability to adapt. to the situation at a time when the US Federal Reserve is raising interest rates to fight inflation.

Reasons that will ease the demand for raw materials

Al-Khatib explains that what Buffett is saying is that the “overspending” that has taken place in the past cannot continue, and that conditions have started to change and will continue to change in the period ahead, indicating that American companies are abandoning a large number of their employees. , in addition to the banking crises. In America, it will push it to change its strategies for granting loans, and these are all reasons that will reduce the demand for all goods and services in the period to come.

doorbell

For his part, financial analyst Pierre Khoury said in an interview with “Sky News Arabia Economy” that Hakim Omaha has the ability to guess the state of the market, and what he said is a red flag on the market. state of the US economy, and he is making it clear that economic activity in America is going to deteriorate, which explains his bleak outlook for his business.

cash is king

Khoury notes that Buffett announced at Berkshire Hathaway’s shareholders’ meeting that the group had sold $13.3 billion worth of stock, invested $4.4 billion in the process of buying back its shares and put $2.9 billion into other securities, indicating that Buffett knows that when a recession looms, cash is king.

Nothing is certain tomorrow

Khoury adds that the US market is currently going through a very turbulent phase, as it ended 2022 with major corporate layoffs, then came the crisis of the collapse of the banks, which created a state of instability. and caused concern among depositors, as the focus currently shifts to how to avoid catastrophe, default, and the resulting repercussions on the global economy and the U.S. economy, of where one can understand Buffett’s assertion that things will get worse and nothing is certain tomorrow, not next year for markets and businesses.

Read the Latest World News Today on The Eastern Herald.